What Are Liquid Assets?

Content

These assets comprise the current asset portion of your balance sheet and are expected to be converted or used within a year. Current assets are short-term assets that can be used https://www.bookstime.com/articles/what-is-order-of-liquidity up or converted to cash within one year or one operating cycle. Non-current assets are long-term assets that a company expects to use for more than one year or operating cycle.

- A quick sale can have some negative effects on the market liquidity overall and will not always generate the full market value expected.

- A liquid asset must have an established market in which enough buyers and sellers exist so that an asset can easily be converted to cash.

- Thus, the Order of permanence is considered to be the reverse of the Order of Liquidity.

- We can approximate a firm’s liquidity by using formulas and financial ratios to measure it such as the current ratio.

- For example, some companies will list Accounts Payable as the first current liability account.

Examples may include stocks, bonds, preferred shares of stock, index funds, or ETFs. Cash is the most liquid asset possible as it is already in the form of money. This includes physical cash, savings account balances, and checking account balances. It also includes cash from foreign countries, though some foreign currency may be difficult to convert to a more local currency. Short term liabilities like creditors, bank overdraft are matched with assets which are more liquid, while long term liabilities are matched with lesser liquid assets. Assets are always listed first which includes the most liquid assets, then liabilities are listed typically in the order of how quickly they will be…

Browse the financial glossary in alpabetical order

Under the order of liquidity method, an organization’s current and fixed assets are entered in the balance sheet in the order of the degree of ease with which they can be converted into cash. This ratio measures the extent to which owner’s equity (capital) has been

invested in plant and equipment (fixed assets). A lower ratio indicates a proportionately

smaller investment in https://www.bookstime.com/ fixed assets in relation to net worth and a better cushion

for creditors in case of liquidation. The presence of substantial leased fixed assets (not

shown on the balance sheet) may deceptively lower this ratio. In order to fully understand liquid assets, you have to also know what assets are considered illiquid, meaning they can’t be converted to cash quickly and easily.

Which assets are most liquid?

Cash is the most liquid asset possible as it is already in the form of money. This includes physical cash, savings account balances, and checking account balances.

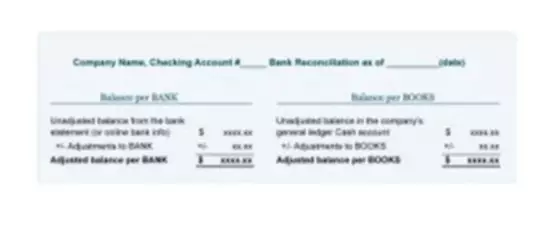

Liquidity is a measure of a company’s ability to pay off its obligations. A company will have various assets and the order of liquidy of such assets will be prepared by a company to find out the liquidity of the company. To serve this purpose, assets and liabilities are recorded on the balance sheet in a specific order.

A guide to liquidity in accounting

Materials are not purchased for

conversion into finished products. Instead, the finished products are purchased

and are sold directly to the customers. Several operating cycles may be completed

in a year, or it may take more than a year to complete one operating cycle. The time required to complete an operating cycle depends upon the nature of

the business.

Assets are prioritized by their liquidity, whereas liabilities are prioritized by their permanency. A specimen of the balance sheet marshalled using order of permanence is shown below. In practice, the most widely used title

is Balance Sheet; however Statement of Financial Position is also acceptable.

The Balance Sheet

A liquid asset is cash on hand or an asset that can be easily converted to cash. In terms of liquidity, cash is supreme since cash as legal tender is the ultimate goal. Assets can then be converted to cash in a short time are similar to cash itself because the asset holder can quickly and easily get cash in a transaction exchange.

Sign up for Shopify’s free trial to access all of the tools and services you need to start, run, and grow your business. Try Shopify for free, and explore all the tools and services you need to start, run, and grow your business. Salaries that company budget shows will be paid to employees within the next year. Sales for the first four days in January 2018 in the amount of $30,000 were entered in the sales journal as of December 31, 2017. Of these, $21,500 were sales on account and the remainder were cash sales.

AccountingQA Navigation

A customer may have bought something on credit; after the credit term is up, the company is due to receive cash. Similarly, the fixed or long-term liabilities are shown first under the order of permanence method, and the current liabilities are listed afterward. The U.S. Department of Housing and Urban Development has outlined liquid asset requirements for financial institutions to become FHA-approved lenders. For example, non-supervised mortgagees must possess a minimum of $200,000 of liquid assets at all times.

Although your intangibles lack physical substance,

they still hold value for your company. Sometimes the rights, privileges and

advantages of your business are worth more than all other assets combined. These

valuable assets include items such as patents, franchises, organization expenses

and goodwill expenses. For example, in order to become incorporated you must

incur legal costs.

Non-current Assets

You should make

these investments in securities that can be converted into cash easily; usually

short-term government obligations. Prepaid expenses include anything you’ve paid for but expect to benefit from over time. If you’ve paid for a year-long lease or an extended insurance policy, you have prepaid expenses.

Aquis Markets launches Dark to Lit Sweep for liquidity across both … – FinanceFeeds

Aquis Markets launches Dark to Lit Sweep for liquidity across both ….

Posted: Tue, 06 Jun 2023 17:05:00 GMT [source]

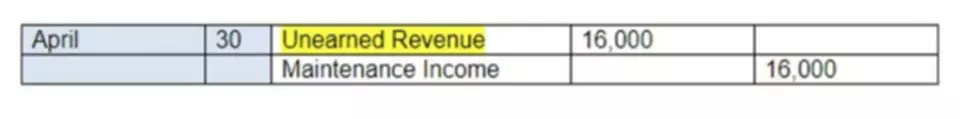

Of this amount, $23,324 was received on account after cash discounts of 2% had been deducted; the remainder represented the proceeds of a bank loan. The two most common orders followed in this process are Order of liquidity and Order of permanence. For example, some companies will list Accounts Payable as the first current liability account.

Understanding Liquid Assets

Any of your business’s outstanding debts or IOUs are considered accounts receivable. It’s the money that clients or customers still owe you for services already rendered or goods already delivered. Some companies or entities may face requirements on the value of liquid assets. This restriction is to ensure the short-term health of the company and protection of its clients. On one hand, a company has a legal claim to cash that is due to them often as part of their business operations.

When considering liquid assets, be aware that a company may not collect all of its accounts receivable balance. For this reason, liquid asset analysis may include the contra asset allowable for doubtful accounts balance to reduce accounts receivable to only what the company thinks they will collect. Cash equivalents are other asset holding that may be treated similar as cash due to their low risk (or insurance coverage) and short-term duration. Examples of cash equivalents include Treasury bills, Treasury notes, commercial paper, certificates of deposit (CD), or money market funds. Note that some items may have less liquidity based on terms of the vehicle.

However, your current assets are only those that will be converted into cash

within the normal course of your business. The other assets are only held because

they provide useful services and are excluded from the current asset classification. If you happen to hold these assets in the regular course of business, you can

include them in the inventory under the classification of current assets. Current

assets are usually listed in the order of their liquidity and frequently consist

of cash, temporary investments, accounts receivable, inventories and prepaid

expenses. A liquid asset is an asset that can easily be converted into cash in a short amount of time.

- Due to usually higher volumes of activity for money market securities, it’s fairly easy to buy and sell in the open market, making the asset liquid and easily convertible to cash.

- You will be more likely to sell your vehicle for less and may find it difficult to find buyers for your top dollar quote.

- A company will have various assets and the order of liquidy of such assets will be prepared by a company to find out the liquidity of the company.

- Sign up for Shopify’s free trial to access all of the tools and services you need to start, run, and grow your business.

Average Rating